In today’s digital age, secure communication is paramount, especially in the accounting profession, where sensitive data is regularly exchanged from the client’s end.

While email has been the go-to method of communication for many years, it’s becoming increasingly clear that it may not be the most secure or efficient option.

According to the Phishing Activity Trends Report by APWG, there were more than 1 million phishing attacks in the first quarter of 2022, reaching a monthly peak in March 2022.

Enter secure client portals with a more robust and protected environment for sharing sensitive financial information. In this blog post, we will shed light on the growing importance of having an efficient interface for your clients to interact with your business.

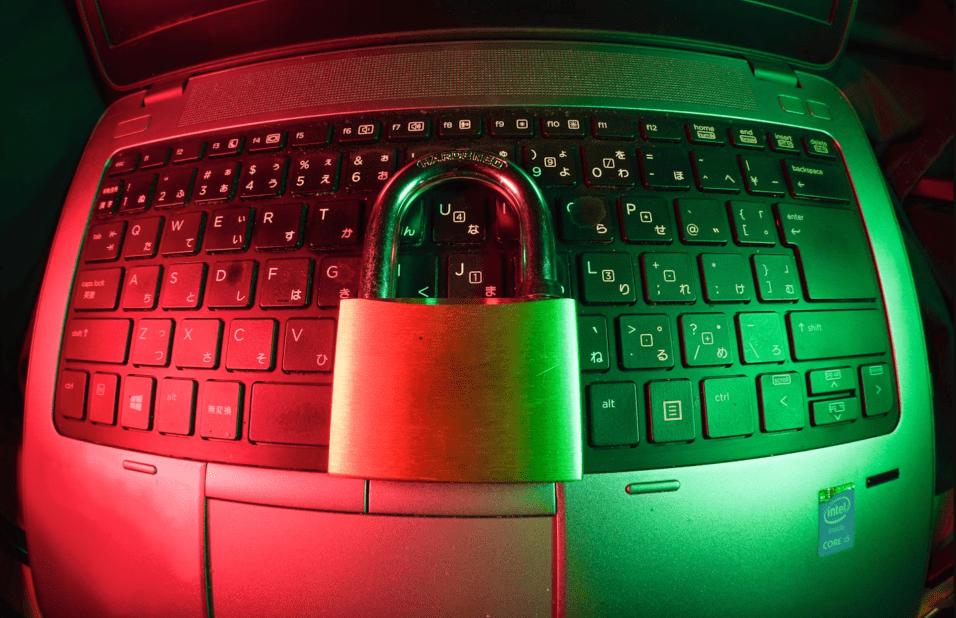

The Risks of Email Communication

Email has long been the backbone of business communication, but as technology has evolved, so too have the security risks associated with this tried-and-true method.

In the accounting profession, which survives on the protection of a client’s sensitive and private financial information, the inherent vulnerabilities of email cannot be overlooked.

Security Issues

A significant drawback of email lies in its inherent vulnerability. Hackers or other malicious individuals can intercept emails, leading to the exposure of sensitive information to unauthorized parties.

Moreover, the ease with which emails can be forwarded amplifies the risk of data breaches, as a single misguided click can send confidential data to unintended recipients.

Compliance Concerns

Compliance is another critical issue when it comes to email communication in accounting. With regulations like HIPAA and GDPR mandating strict data protection protocols, email’s limitations become even more apparent.

The lack of encryption, access controls, and audit trails means that email may not meet the rigorous standards set forth by these regulations. This risks leaving your firm vulnerable to costly penalties and reputational damage.

Limits On Sharing Large Files

Moreover, email’s shortcomings extend beyond security concerns. Sharing large files, such as tax returns or financial statements, can be cumbersome due to attachment size restrictions. Collaborating on documents in real-time is also a challenge, as version control and simultaneous editing are not inherent features of email.

In light of these risks and limitations, it’s clear that accounting firms must explore more secure and efficient alternatives to email communication.

The Benefits of Secure Client Portals in Accounting

In the fast-paced world of accounting, where time is money and security is paramount, the limitations of email communication have become increasingly apparent.

Secure client portals offer a robust solution to these challenges, providing a safe and efficient platform for exchanging sensitive financial information.

Enhanced Security

One of the most significant advantages of client portals is their enhanced security features. With encryption of data both in transit and at rest, you can rest assured that your client’s confidential information is protected from prying eyes. According to Mango Practice Management, this is especially non-negotiable when their payments are involved.

Utilizing multi-factor authentication and detailed access controls enhances security by adding safeguards, permitting only authorized individuals to enter the portal.

Moreover, detailed audit trails and activity logging provide a level of accountability that is simply not possible with email.

Seamless Compliance

From a compliance perspective, client portals are a game-changer. Designed to meet the stringent requirements of regulations like HIPAA, GDPR, and SOC 2, these platforms provide a secure environment for storing and transmitting sensitive financial data.

Beyond mitigating potential financial penalties, these actions showcase a firm’s dedication to client confidentiality.

Streamlined Management

Beyond security and compliance, these robust portals streamline collaboration and document management. With a centralized repository for financial documents and reports, your clients and your platform can access the information they need anytime, anywhere.

Real-time collaboration tools and version control features make it easy to work together on complex projects, while streamlined file sharing and organization keep everyone on the same page.

By leveraging the power of secure client portals, accounting firms can enhance their security posture, meet compliance requirements, and improve the overall client experience. In a world where data privacy and efficiency are non-negotiable, client portals are the key to unlocking success in the digital age.

Implementing a Secure Client Portal

Transitioning from email to a secure client portal may feel like a formidable task, but with careful planning and execution, the process can be seamless.

The initial phase should entail conducting a comprehensive evaluation of the specific needs and demands of your accounting firm. Factors to contemplate include the extent of your clientele, the range of services provided, and financial considerations.

After carefully defining your requirements, delve into a comparative analysis of various client portal solutions. Prioritize platforms boasting robust security measures, intuitive user interfaces, and seamless integration with your existing accounting software.

Take advantage of vendor-provided demos and actively seek references from fellow accounting firms.

As you prepare to implement your chosen client portal, clear communication with your clients and staff is essential. Emphasize the advantages of the updated system, including heightened security measures, enhanced teamwork capabilities, and unrestricted availability of financial records around the clock.

Moreover, be sure to provide ample training and support during the transition process to ensure everyone feels comfortable and confident using the new platform.

By following these key steps and remaining committed to secure communication, your accounting firm can successfully implement a client portal that enhances your security posture, streamlines your workflows, and delights your clients.

To conclude, in this rapidly evolving landscape of consumer behavior, staying abreast of changes is paramount. What worked a few years ago might not suffice today. Hence, it’s crucial to elevate your safety and privacy measures.

Additionally, as an organization, anticipating and preparing for potential threats is imperative. This proactive approach ensures readiness for any scenario that may arise in the ever-shifting marketplace.